We were recently interviewed in Germany and thought we’d share this content in English too. This Q&A is a good representation of Grünfin’s values and approach.

1. At Grünfin, you focus on impact or sustainable investing, can you define what that means exactly?

Indeed impact or sustainable investing has the same meaning to us. We define it as investing in companies and governments that treat the planet and its people with respect.

More specifically, we define it by mainly focusing on three impact areas:

- climate,

- gender equality and

- health.

#1 Climate

Our guiding star is the Paris Agreement, an international climate treaty adopted by 196 countries, whose main goal is to reach net zero greenhouse gas emissions by 2050 to limit global warming. Achieving this goal saves our planet.

We look for exchange-traded funds (ETFs) that, through their company investments, are aligned with the goal of the Paris Agreement. This may include companies operating factories fully with renewable electricity, setting net zero emissions across their supply chain by or earlier than 2050, developing key green technologies, among many examples.

#2 Gender Equality

We seek ETFs composed of companies ranking highly on gender equality as per Equileap’s criteria. This means corporations scoring highly for women in:

- promotions,

- equal pay,

- management representation,

- board of directors positions,

- parental leave,

- sexual harassment,

- human rights and several more.

#3 Health

We look for ETFs invested in companies pushing the boundaries in medical treatment and technology. These companies are working on innovative cures for cancer, migraines, epilepsy, among many other diseases.

It’s worth clarifying that these three impact areas apply to our stock investments. Bond investing is a bit more challenging in these areas as the availability is less, but our climate bonds are still funding projects with direct environmental benefits (green bonds). Our gender equality and health bonds are invested in funds promoting sustainability characteristics, albeit, more general and less specific to the theme.

2. We see the term ESG investing bandied around a lot, what is the difference between that and sustainable investing?

Indeed we see a lot of terms thrown around: ESG (Environmental, Social, Governance), sustainable, impact, values-based, ethical, green, thematic and socially responsible investing.

Confusing, right?! Don’t worry! Not even the experts agree on what each exactly means.

Some of us spent nearly 20 years in major financial institutions in hubs like New York City and even we can’t figure out what the differences are because, honestly, they are all pretty much the same. We have previously written about impact, sustainability and ESG investing.

The important thing is to differentiate between the old and new way of investing.

The old way focused simply on risk and return. In other words, an investor hoped to achieve maximum returns while minimizing the necessary risk.

The new way still analyzes risk and return, but adds a third dimension: investments that do good for the planet and its people. This third dimension can be highly subjective, that’s why it’s critical to understand how your financial provider defines it. At Grünfin, we define as mentioned above under our focus areas: climate, gender equality and health.

3. During times of crisis, investors used to retreat into tried and trusted safe havens, such as gold or government bonds, while sustainable investing was viewed as a fashion, how much do you think this has changed?

Developed government bonds should continue being safe havens in times of crises and playing a key role in portfolio diversification. The first half of 2022 was a remarkable anomaly in that both stocks and bonds fell in the double digits.

We believe this is specifically tied to the end of the low-interest era and that in the future, government bonds will return to being safe havens.

The market will likely continue viewing gold as a safe haven too. We don’t own gold because we don’t see the sustainability benefit.

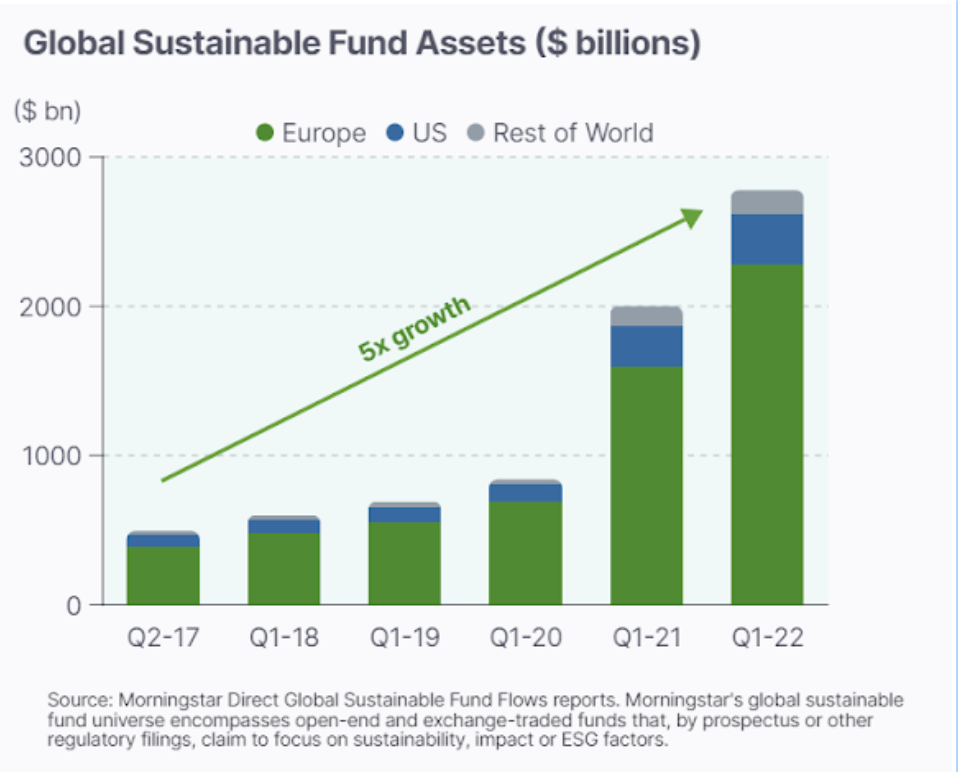

As for sustainable investing, it’s in its early days, but we don’t believe it’s just a fashion. It has a huge tailwind as shown by the following examples:

- Sustainable fund assets globally have grown five times in the last five years.

- Nearly 200 countries signed the Paris Agreement with the goal of achieving net-zero emissions by 2050.

- 400 of the world’s largest public companies with $14 trillion in combined sales have committed to net zero targets.

- The EU is imposing quotas to ensure women have at least 40% of seats on the boards of large companies.

- 95% of millennials and women prefer sustainable investing.

- 90% of professional investors expect their firm’s commitment to sustainability to increase in the next 5-10 years.

- EU aims to ban products, imports made with forced labor

4. There are some fears that excessive emphasis on sustainability could harm a company’s competitiveness and returns, how accurate is that?

We don’t believe that’s accurate.

Research published in the Harvard Business Review found that firms with more women in senior positions are

- more profitable,

- more socially responsible,

- and provide safer, higher-quality customer experiences — among many other benefits.”

Some of the world’s largest and most successful companies are leading the way. Corporate giants like L’Oreal, Unilever, American Express and Sanofi are leaders in gender equality.

Microsoft, SAP and Apple are taking great action to stop climate change, such as running operations with 100% renewable electricity, working with local governments to install more renewable energy that benefits communities, helping their smaller suppliers align to the Paris Agreement goal, among others.

No company is perfect and it’s easy to point out their imperfections (we must continue highlighting their imperfections too). However, what’s most important is to understand whether their actions as a whole provide a substantial net good and whether they’re moving in the right direction.

400 of the world’s largest public companies have committed to net zero targets, as we mentioned above, meaning the overall stock market is in itself becoming more sustainable. As more companies increase their sustainability credentials, the line between sustainability and returns blurs as they become one. In other words, we strongly believe that sustainable investing becomes the new normal of regular investing.

5. From a risk management perspective, how safe is investing in sustainable businesses? How do you protect from any future crises?

We believe in the power of long-term investing as stock markets have historically shown their tendency to rise over time.

Sustainable businesses, like most stocks, tend to rise and fall along with the overall market. Therefore, investing with a long-term horizon helps to not get distracted by short-term downward movements.

However, just like investing in any other type of asset, diversification is super important to reduce the overall risk of your portfolio. You don’t want to be concentrated in only a few companies.

The beauty of sustainable investing is that it can include obvious sectors like solar panel and wind energy producers, but also less obvious industries like consumer goods, financial services, pharmaceuticals and technology. In other words, it’s possible to build a highly diversified portfolio.

A mix of stocks and bonds is also important.

6. How much of an effect has the Covid crisis had on corporate behaviour with regards to sustainability?

The Covid crisis has had an enormous effect on this matter. Leading companies realize that to operate efficiently they need:

- healthy workforces,

- healthy consumers,

- functioning supply chains and

- open borders.

Covid also exposed a scary planetary reality. Despite the world shutting down in 2020, greenhouse gas emissions fell only by 5% vs 2019. Sustainable companies recognize that much more must be done.

Covid also increased the gap between the wealthy and poor. Leading companies are tackling this by ensuring livable wages for all employees.

7. What sectors does Grünfin invest its clients' money in and why?

Grünfin’s focus areas are climate, gender equality and health, as defined earlier in more detail.

Our investments include obvious sectors like solar panel and wind energy producers, but also less obvious industries like consumer goods, financial services, pharmaceuticals and technology.

Our portfolios are exposed mainly to Europe and the US. High-risk portfolios have their largest weight in stocks; whereas low-risk portfolios are mainly in government and corporate bonds that rank highly in social responsibility.

In summary, Grünfin portfolios are highly diversified across different companies and governments, geographies and across stocks and bonds.

8. What are Grünfin’s core values?

Grünfin is a sustainable investing platform for people who care about their impact. Grünfin has the ambition to become the largest sustainable, values-based investment platform in the EU making sustainable investing easy and impactful.

We also believe in the basics of investing:

- long-term horizon,

- continuous investing of savings,

- low-cost ETFs and

- diversification.

Additionally, we drive impact through our activism.

Via our partnership with ShareAction we aim to influence the sustainability agenda of some of the world’s largest companies.

Here’s what we’ve done to drive investor activism:

- Deutsche Bank: At the German banking giant’s annual shareholder meeting, we asked about its plans to finance the longest heated crude oil pipeline in the world, which will stretch for 1.444 km from Uganda to Tanzania. Deutsche Bank refused to comment, but according to the Stop EACOP Campaign, it has abandoned the project. We will continue monitoring and apply pressure if Deutsche Bank u-turns.

- Credit Suisse: We publicly called on Credit Suisse, the Swiss banking giant, to immediately and significantly reduce its financing of oil & gas companies. Here’s the Reuters article talking about this initiative and Grünfin’s participation.

- Nestle, Danone, Kellogg and Kraft Heinz: We signed letters directed to the Chair of the board, the most powerful position in a company, of each of these urging them to offer healthier foods to tackle obesity, which affects 650 million people worldwide. Given the global reach of these corporations, they have a tremendous responsibility on what they feed all of us.

- Unilever: We met with Unilever’s Chief R&D Officer of Nutrition to follow up on their commitment to better disclose the healthiness of their food products and set targets for increasing their share of healthy foods sales. Unilever continues driving to deliver on such commitments. Every day 2,5 billion people across 190 countries consume Unilever’s products.

- PepsiCo: We met with Pepsi’s senior management regarding the healthiness of their products. This was our first meeting and quite constructive, so more to come.

9. If someone is interested in investing with Grünfin, what do they need to do to get started?

Just click on the link below. You can easily set up a portfolio for yourself, child or family. Signing up is fast and with no minimum requirements!

These could also be interesting to you

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.

Sustainability's highest standard. Grünfin is now a B-Corp

Certified B Corporations, or B Corps, are companies verified by B Lab, third party, to meet high standards of social and environmental performance, transparency, and accountability.

What a Difference a Year Makes (Grünfin Update & Quarterly Statement)

What happened in financial markets in 2023 and how we see 2024?