Your stock portfolio will invest in the S&P 500 companies most aligned to a greener future. Through a stock ETF, you’ll be exposed to the S&P 500 Paris-Aligned Climate Index, a subset of the S&P 500 that includes the companies most committed to the Paris Agreement.

What is the Paris Agreement?

The Paris Agreement is the most ambitious, global and realistic climate treaty ever created to save the planet! It was agreed by nearly 200 countries and its main goal is to control global warming to 1,5 - 2,0°C by reducing the world’s greenhouse gas emissions to net zero by 2050.

This Agreement was adopted in 2015-16 and includes the US, EU, China and India, covering 98% of the world’s emitters.

What’s the S&P 500?

The S&P 500 is a stock index essentially composed of the 500 largest publicly traded companies in the US. It is regarded as one of the best indicators of the overall US stock market.

And, since the US is 63% of the world’s stock market and accessible to most international investors, it’s also an indicator of sentiment globally.

What’s the S&P 500 Paris-Aligned Climate Index?

The S&P 500 Paris-Aligned Climate Index is composed of roughly 350 of the 500 companies from the standard S&P 500 Index that are most aligned with the Paris Agreement.

The index provides exposure to a variety of sectors like tech, healthcare, financials, consumer products, communication services, real estate, materials and utilities.

Companies must meet the following climate objectives/criteria:

- 1,5°C target: Alignment to a 1,5°C climate scenario;

- 50% less emissions: Reduction of overall emissions intensity compared with the S&P 500 by at least 50%;

- 7% carbon reduction: Self-decarbonization rate of emissions intensity equating to at least 7% reduction on average per year;

- No oil & gas companies;

- No disqualified UNGC companies: The United Nations Global Compact (UNGC) is a pact to get firms worldwide to adopt sustainable and socially responsible policies.

Why is Grünfin offering this new S&P 500 Planet Friendly theme?

We recognize that many investors want exposure only to US companies through the S&P 500, the most recognizable and widely followed stock index in the world.

However, many investors want exposure to US companies, but only to those doing good things for the planet.

We believe this theme solves this!

We analyzed the universe of climate friendly ETFs that track a subset of the S&P 500. There are a few, but we selected the one ranking highest based on over 20 different criteria like SFDR, MSCI and Morningstar sustainability rankings plus factors like carbon footprint, board gender diversity, exposure to controversial weapons, violations of UN Global Compact principles, independence of board, cost of ETFs, dividend distribution status, underlying leverage risk of the ETF, among others.

We monitor and constantly analyze these ETFs in case something material changes and/or a much better ETF emerges.

Can I invest in a 100% stock portfolio for this theme?

Due to popular demand, yes you can!

How has the S&P 500 Paris Aligned Climate Index performed vs the standard S&P 500 Index?

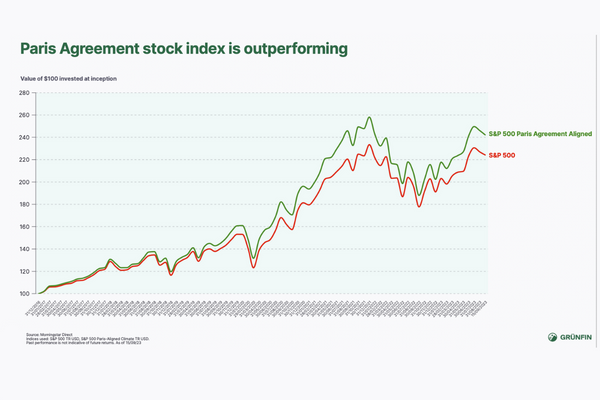

The Paris Aligned Climate Index has outperformed since 2016, when the Paris Agreement went into effect.

However, note that past performance does not guarantee future returns.

How is the S&P 500 Planet Friendly theme different from the Climate theme?

You may have noticed that we offer another theme called Climate. Climate invests in a combination of European and US stocks, making it more global. Another difference is that Climate’s exposure to European stocks is more than double that to the US.

The Planet Friendly theme invests exclusively in the stocks of US companies.

What’s an example of a company in the S&P Paris Aligned Index?

Apple is currently the biggest holding in the index. As the world’s largest company, Apple has a huge responsibility on how it treats the planet. Here’s a super fun and short video starring its CEO where Apple’s climate achievements and goals are stated.

Here are a few Apple highlights in case you don’t have time for the video:

- Operates on 100% clean electricity in all its offices, stores and data centers.

- Reduced its emissions by 45% since 2015.

- Goal is net zero emissions for its entire product footprint by 2030.

- 300 of its major suppliers committed to using clean electricity.

Can I add bonds or other themes to the S&P 500 Planet Friendly theme?

Yes, you can add bonds or other themes.

For bonds, you’ll be invested in the same ETF used in Climate portfolios. This ETF can invest in bonds aligned with the Paris Agreement and/or issued to fund projects with direct environmental benefits. Bond ETFs can invest in multiple geographies including Europe and the US.

**For other themes, you may select them too and combine them with the Planet Friendly portfolio. The other themes are Climate, Gender Equality and Health. **

These could also be interesting to you

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.

Sustainability's highest standard. Grünfin is now a B-Corp

Certified B Corporations, or B Corps, are companies verified by B Lab, third party, to meet high standards of social and environmental performance, transparency, and accountability.

What a Difference a Year Makes (Grünfin Update & Quarterly Statement)

What happened in financial markets in 2023 and how we see 2024?